Square for Business

Square is everywhere. Millions of merchants, vendors, and companies large and small use Square for business transactions. Nearly everyone can recognize the small, white, square gadgets that plug into smartphones at farmers markets and sit on countertops in coffee shops.

But just a short decade ago, accepting credit card payments was a drag for small businesses — and a near impossibility for microbusinesses. Getting set up to swipe required a special account, special equipment, and a lot of very special fees.

One purchase gone awry changed all that. In 2009, an artisan glassblower named Jim McKelvey lost a big sale because his buyer could only pay with a credit card. Fortunately, he was a friend of Jack Dorsey, the founder of Twitter, who knew a few things about thinking big.

Together, they came up with Square, a mobile credit card payment method that allows vendors to accept payments anywhere with a smartphone, skipped the merchant account process, and offered lower processing fees. This removed the barrier to entry for accepting credit card payments so dramatically that it essentially democratized card payments and turned the whole industry on its head.

In short, using Square for business transformed everything, allowing anyone with a mobile device to become a roving checkout register.

This means that as a business owner, you’ll never miss a sale from a card-only buyer, no matter where or what you’re selling. Even better, Square helps businesses digitize all of their financial operations, eliminating the need to fuss with paper invoices or process checks and cash. Those efficiencies can help companies grow fast — and so can easy access to business loans through Square Capital. Plus, Square is famous for their affordable transaction fees, meaning you end up with more money.

Needless to say, those familiar point-of-sale gadgets and easy, low-cost transactions are only part of the story. From customer engagement to inventory management, merchants are using Square for business services that go beyond processing payments.

Here, we’ll dive into exactly how Square works, their full suite of service offerings, how to get started, and how the popular payment processor can help your business grow.

Square as a leading payment method

What is Square?

In the simplest form, Square is a credit card and point-of-sale payment processor. They use mobile technology to allow businesses, artists, vendors, and organizations of all kinds to accept card payments using a smartphone or tablet. Increasingly, businesses are using Square to take both mobile and in-store payments.

Square’s hardware gadgets include

- Square Reader for magstripe (magnetic stripe)

- Square Reader for contactless and chip

- Square Terminal

- Square Stand

- Square Register

The answer to “What is Square?” goes beyond the fact that Square is a payment processor, though. Square is also an “operating system for small business” that offers a suite of software solutions to help businesses make the most of their time and money — and grow and thrive.

As one entrepreneur told Venturebeat, Square not only made it possible for him to process credit cards, they also gave him the power to seamlessly run his entire bakery business with their back-office software.

The Square Point of Sale app, including the simple but robust Square Dashboard, helps you manage your business on any device (in or away from the office), and includes features like real-time analytics and sales reporting, an administrative dashboard, inventory management, marketing, customer relationship tracking, payroll and employee management, marketing, and — of course — the ability to take orders.

Another way you can use Square for business is as a funding source. Square Capital offers sellers business loans in amounts ranging from $500 to $250,000 with simplified fees and easy loan management tools.

How does Square work?

Before you ask, “How does Square work?” you need to ask yourself, “How do I work?” The way you use both the payment processing company’s software and hardware largely depends on your business model and setup.

Here’s a quick, high-level rundown of what you can expect to do when you use Square:

- Create a free account and order the Square hardware of your choice depending on the nature of your business.

- Download the Square Point of Sale app.

- Customize your Square Point of Sale app or online dashboard based on your inventory, your customers, the type of data you’d like to collect, etc.

- Once your Square device arrives, start accepting card payments. Alternatively, invoice clients via the Square Dashboard or enter payment information manually.

- The money you’ve made from your sales, minus Square’s transaction fees, will be deposited into your account in one to two business days.

Overview of Square products

If you know anything about using Square for business, it’s that the company makes mobile payments possible. But that’s just the beginning. Here’s an overview of Square’s product offerings, from card readers to business loans, all of which are available for purchase, download, or order from Square’s website.

Related: Square Review: Pros and Cons

Managed payments

Square may have made their credit card processing debut with the small, white dongle that attaches to a smartphone or tablet, but over the last 10 years their offering has evolved. Today, businesses can take advantage of everything from the original Square Reader to the sleek Square Terminal, which makes it possible to process payments, print receipts, and ring up sales from one modern device.

Here’s how managed payments work on Square for business:

Square hardware options

- Square Reader for magstripe. This is the classic white Square reader you use to swipe magnetic strips on payment cards. You can order it with a headphone jack or a Lightning connector. It plugs into a smartphone or tablet and translates card info into the Square Point of Sale app. It has always been and continues to be free.

- Square Reader for contactless and chip. This is the next-generation card reader. It reads EMV chips (the microchips now on payment cards) and near-field communication from payment apps like Apple Pay and Google Pay. It’s still a white square, but it’s bigger than the original magstripe reader. And instead of plugging in, it connects to your smartphone or tablet using Bluetooth. You can mount the reader to a countertop stand or mount it to your iPhone 7 or 7 Plus with a special OtterBox case. This reader costs $49.

- Square Terminal. No smartphone? No problem. The Square Terminal is the connected device, plus the reader. It works with magnetic stripes, EMV chips, and near-field communication payments — and it prints receipts. This is a great option for businesses that need employees to accept mobile payments. Square Terminal costs $399.

- Square Stand. Any tablet can become a stationary point of sale with the Square Stand. It comes with a magnetic stripe reader built in and a remote reader for EMV chips and near-field communication payments. The stand swivels so customers can easily sign the screen. You can add a cash box, barcode scanner, and a receipt printer as accessories if needed. The Stand itself costs $199.

- Square Register. This is Square’s most permanent, stationary, all-in-one option. It’s both the stand and the device. It comes with a customer-facing touchscreen that accepts magnetic stripes, EMV chips, or near-field communication payments, and the touchscreen can sit on the counter or be mounted to the Square Register. You can add a cash box, barcode scanner, and a receipt printer as accessories if needed. Before those accessories, Square Register costs $999, or 24 monthly payments of $49.

Square software

- Square Point of Sale. This is the standard POS app for Square. Any business can use Square Point of Sale to accept and process payments. It also comes with real-time analytics and sales reporting, Square Dashboard, inventory management, customer relationship management, employee management, payroll, and invoicing.

- Square for Retail. This is the POS option specifically geared toward retailers. It emphasizes inventory management, customer relationship management, and multiple purchase options, like in-store pickup or shipping.

- Square for Restaurants. This is the POS option created for restaurants. It manages reservations and seating, orders by course, multiple menus, as well as all other Square Point of Sale features.

- Square Appointments. This is Square’s POS app for service businesses built around appointments. It manages online booking, cloud-based calendars across team members, and customer relationships.

Employee management and payroll

Square for business operations makes managing employees easier. First, the Square Point of Sale app allows businesses to do the following starting at $5 per month:

- Have employees clock in and out inside the app

- Set different levels of employee access to different areas of the Point of Sale app

- Track sales by employee and hours worked

You can also pay everyone quickly and easily using Square Payroll — a full-service payroll system that integrates seamlessly into the operations of any business already using Square Point of Sale. It starts at $34 a month and allows you to

- Pay salaried and hourly employees and contractors

- Provide health insurance and other benefits

- Import time cards and tips

- Run payroll multiple times monthly

- Pay staff from anywhere

Inventory management

The Square Point of Sale app makes it possible to know exactly what you have in stock at all times, no matter where you are. You can import and export thousands of items easily from or into spreadsheets. You also get low-inventory alerts and can manage stock from your Point of Sale Dashboard.

Because retailers have even more advanced inventory needs, Square for Retail offers an entire POS app with additional inventory tools, including

- Tools to create and print barcodes

- Inventory management across multiple locations

- The ability to create purchase orders when stock is low

- Integration with Square Online Store

- Synchronization across in-store and online orders, items, and inventory

- Automated reporting on costs of goods sold, margins, projected profit estimates, and profit margins

Customer management

Nothing endears a customer to a business like a real relationship — and good customer relationship management data can help you build one. Square offers businesses a number of ways to do this.

Square Customer Directory

The Square Customer Directory tool helps you track and manage customers’ interactions and behaviors to customize their experience. It comes free on the Point of Sale app, and with it, you can

- Add customers during checkout

- Securely save credit cards for future purchases

- Personalize the shopping experience using notes, purchase history, and contact info

- Send custom digital receipts

Square Loyalty

Loyalty programs reward customers for repeat visits with special incentives and earned discounts. Square Loyalty pricing is based on the number of loyalty visits, starting at $45 per month. The tool

- Doesn’t require any special equipment

- Allows you to reward customers by visit, by spending, or by purchasing specific items

- Allows customers to sign up at checkout on the Point of Sale app

- Tracks loyalty points on the Point of Sale app, so customers don’t need cards or apps

- Provides loyalty data analytics on the Square Dashboard

Square Marketing

With Square Marketing, you can connect with customers through email. Pricing is based on customer contacts and starts at $15 per month. Features include

- Email design tools

- Customer signup through the Point of Sale app

- Automated campaigns

- Group targeting

- Discounts that can be shared on social media and redeemed with the Point of Sale app

- Email marketing analytics on Square Dashboard

Analytics and reporting

So much of running a successful business relies on gathering and analyzing data. In addition to the data that fuels the inventory, employee management, and customer relationship management tools, Square Point of Sale includes a wide range of analytics and reporting options through Square Dashboard. Using it, you can

- Track and analyze sales by item, sale, time of day, and more

- Compare current sales to last week, last month, or last year

- Check real-time analytics rather than waiting for end-of-day reports

- Analyze customer behavior and returns

SMB loans

For most businesses, growth requires some extra cash flow. Square Capital takes the user-friendly, tech-forward sensibility of their payment processing tools and applies it to business loans. Anyone who uses Square for business could qualify. Here’s how it works:

- Square Capital offers can be found on the Square Dashboard.

- If you have an offer, you can accept it, and money will be deposited as soon as the next day.

- Repayment is deducted from Square transactions or through a flat fee.

- Loan amounts vary from $500 to $250,000.

- More than 250,000 Square customers have received Square Capital loans totaling more than $4.5 billion.

Is Square safe for customers?

“Is it safe?” That’s the question on every business owner’s mind when they’re considering a payment processor.

According to Verizon’s 2019 Data Breach Investigations Report, 43 percent of cybercrime victims are small businesses. That means every credit card transaction, from the smallest business to the largest enterprise, must be secure in order to protect your customers and, by extension, your business. (Fraud and data theft can cost you money and damage your reputation.)

Square is safe for customers. It allows you to take convenient payments anywhere with confidence. Square encrypts all information about merchants and their customers to their servers. It works whether you’re accepting payments on a public or private Wi-Fi connection or through a cellular service.

Square makes securing customer data easy for you too. Because Square is PCI compliant — a security standard required by credit card companies — your business doesn’t have to be. Square securely stores, processes, and transmits payment card data from the moment a card is swiped, using industry-standard security best practices.

Square updates and installs patches on their servers and equipment regularly, and their in-house applications are quality tested and reviewed for security. You never have to worry about walking around with sensitive customer data yourself, because card numbers, magnetic stripe data, and security codes aren’t stored on your devices.

Privacy is another common concern for both customers and business owners. Square never sells information to third-party vendors. While they do ask for your name, location, and other identifying information about you and your business and bank accounts, that data is used only to verify your identity and to give you the best possible service.

How business owners can start accepting payments via Square

Getting set up to start accepting Square online payments is a pretty straightforward process. Here’s how to do it:

1. Sign up with Square

Visit Square’s website to sign up for a Square account.

2. Order your equipment

Decide what type of Square hardware you’d like (if any) and order from the Square website. Options include

- Square Reader for Magstripe: free

- Square Reader for Contactless and Chip: $49

- Square Terminal: $399

- Square Stand: $199

- Square Register: $999 or 24 monthly payments of $49

3. Set up your account to accept payments

Complete your account information with Square so you’re ready to accept payments when your hardware arrives. This includes providing personal information to help verify your account, as well as connecting your bank account. You don’t need to have a business bank account to sign up with Square. The only requirements are that it’s a U.S. account and that it’s a transactional bank account, meaning it allows for deposits and withdrawals.

4. Download the Square Point of Sale app

Download the Square Point of Sale app on any devices you plan to use for business. If you’re going to use the Square Register or Square Terminal as your primary point of sale, you’ll still want to be able to manage your business operations from other devices.

5. Set up your hardware (if you need it)

Setting up your hardware could be as easy as plugging a Square Reader into your smartphone, or it may involve setting up a complete Square Register with accessories like a cash drawer, receipt printer, and barcode reader. Some businesses may not even need hardware at all — if you’re using Square to accept online payments only, for example, you can skip this step.

6. Set up your Point of Sale app with items for sale

You can start accepting Square payments at any time. Just type in the amount of the sale, and run a card (either via your hardware or manually with the Square Virtual Terminal).

But to get the most out of Square, start by inputting your sale items or services into the Square Point of Sale app. This streamlines the sales process at the register, makes it easier to track and manage inventory, and gives you key sales insights that you can use to forecast for the future.

7. Make a sale

When a customer is ready to buy an item, select it from the Point of Sale app. Have your customer swipe, dip, or tap their card as needed on your chosen Square hardware. They’ll OK the amount, sign with their finger, and decide if they’d like a receipt via email, text, or not at all (or printed, if you have that option).

If you’re not using Square hardware to process payments, you can use the payment processor’s Invoice tool on the Square Dashboard, which makes it quick and easy for customers to pay electronically, or you can simply key in their card details and the amount you’d like to charge them using the Square Virtual Terminal.

That’s it. You’re all set up to start accepting card payments with Square.

Types of payments Square accepts

Square works with a wide variety of card-based payment methods, including credit cards, debit cards, prepaid cards, and more. These cards can have magnetic stripes or EMV chips. Using the Square Reader for contactless and chip, you can also accept payments from near-field communication payment methods, like ApplePay.

Card types

Square accepts a variety of card types at the same rates, including

- Credit cards

- Corporate cards

- Debit cards (processed like credit)

- Rewards cards

- Prepaid cards (any remaining balance will show on the receipt)

- Most international cards

- HSA and FSA cards (for licensed healthcare providers and pharmacies)

Credit cards

Square accepts credit cards with these familiar logos on them:

- Visa

- MasterCard

- American Express

- Discover

- JCB (not with chip or contactless, however)

- UnionPay

Transaction fees for Square

Square gives small businesses a pretty sweet deal when it comes to signup and account activation: Both are completely free. What’s more, you don’t need to submit bank statements or credit reports to qualify — as is often the case with more formal merchant accounts.

Similarly, business owners get access to Square’s standard software and dashboard for absolutely no charge. You can use the app; the Square POS system; and even Square’s sales, customer, and analytics portal at zero cost. There are no monthly or annual fees, nor is there a cancellation fee.

On the other hand, Square — like many other payment processors — charges businesses a transaction fee on every electronic payment processed through their system. That means that whether you swipe a customer card via Square’s Reader, enter a client’s payment information manually via the Square Dashboard, or charge a subscriber a monthly fee, a small percentage of the total amount will be deducted by Square before the funds make their way to your bank account.

Unlike many of their competitors, Square doesn’t impose variable fees (or hidden costs) for businesses with annual sales lower than $250,000; all fees and equipment costs are transparent and easily accessible to potential customers via the Square website — so you’ll always know what you’re paying.

Square’s transaction fees vary somewhat according to the hardware and mode used to process a payment, as well as whether you’re using Square’s standard system or one of their specialized systems (e.g., Square for Restaurants).

That said, the fees won’t change depending on the type of credit card your customers use to make purchases.

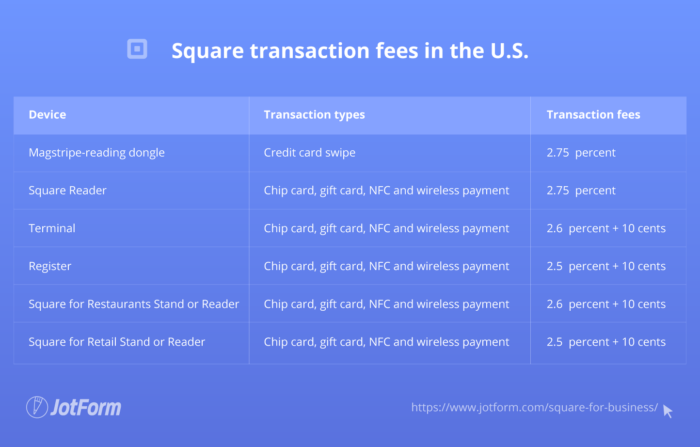

Square transaction fees in the U.S.

Square boasts some of the most affordable transaction fees in the U.S. for businesses doing less than $10,000 per month, and even those bringing home significantly more bacon may find that Square’s an ideal choice thanks to the free technology on offer and the relatively low-cost hardware to boot.

| Device | Transaction types | Transaction fees |

| Magstripe-reading dongle | Credit card swipe | 2.75 percent |

| Square Reader | Chip card, gift card, NFC and wireless payment | 2.75 percent |

| Terminal | Chip card, gift card, NFC and wireless payment | 2.6 percent + 10 cents |

| Register | Chip card, gift card, NFC and wireless payment | 2.5 percent + 10 cents |

| Square for Restaurants Stand or Reader | Chip card, gift card, NFC and wireless payment | 2.6 percent + 10 cents |

| Square for Retail Stand or Reader | Chip card, gift card, NFC and wireless payment | 2.5 percent + 10 cents |

If you use Square’s free credit-card reading dongle with your smartphone or tablet, the only fee you’ll pay for sales via swiped cards will be 2.75 percent of the total transaction, including taxes and tips.

To accept chip cards, you’ll need to purchase a Square Reader for contactless and chip for $49. The same fees — 2.75 percent of the total transaction — apply for inserted chip cards, prepaid gift cards, wireless near field communication (NFC) payments, or the merchant POS mobile app.

Fees for swipe, chip, and NFC payments on the Square Terminal are 2.6 percent plus 10 cents, and they’re 2.5 percent plus 10 cents on the Square Register. Square for Restaurants using a Square Stand or Reader costs 2.6 percent plus 10 cents, while Square for Retail using a Stand or Reader costs 2.5 percent plus 10 cents.

For manually entered payments, the transaction fees are 3.5 percent plus 15 cents. Square charges a 2.9-percent transaction fee plus 30 cents on

- Invoices

- Online store payments

- E-commerce card on file payments

- Square e-commerce payments

If you invite friends and fellow merchants to use Square, both you and your invited friend can receive processing fee reimbursements on up to $1,000 in sales over the next 180 days.

Hardware costs

Apart from transaction fees, you have to pay some up-front costs, and in some cases ongoing costs, for most Square devices.

| Device | Cost |

| Swipe-reading dongle | Free with your account; $10 for each additional swipe-reading device |

| Square Reader | $49 |

| Square Terminal | $399 (12-month payment option available) |

| Square Stand | $199 |

| Square Register | $999 (two-year payment option available) |

Equipment fees are as follows:

- A smartphone or tablet reader with swipe capability is free when you open and activate your Square account — they’ll even ship it to you at no charge.

- Additional swipe-readers are $10 each.

- The Square Reader with chip reader capability is $49.

- The Square Terminal is $399 with a 12-month payment option.

- The Square Stand for tablet is $199.

- The Square Register is $999 with a two-year payment option.

In comparison, Merchant Service’s top-selling wireless handheld credit card reader, the Nurit 8020, can range from $600 to $650.

Software costs

Again, there is no fee for downloading the basic POS application or using the standard online dashboard or app.

However, if you want to take advantage of Square’s suite of add-on applications, ranging from payroll and employee management to invoicing to the wide-ranging Square for Retail, which includes inventory and billing, financial, and sales reporting capability, there are some additional costs.

Likewise, beginning in 2016, Square partnered with restaurant and food services software management provider TouchBistro to launch Square for Restaurants and pair that program’s features with Square’s payment and hardware capabilities. This specialized service also comes with a separate fee determined by the number of locations and the number of devices at each location using Square’s POS app.

Fees include a $29/month subscription fee plus $5/month per employee for payroll, $5/month per employee for employee management, $60/month per device per location for Square for Retail or Square for Restaurants, and $69/month to pair Square for Restaurants with TouchBistro.

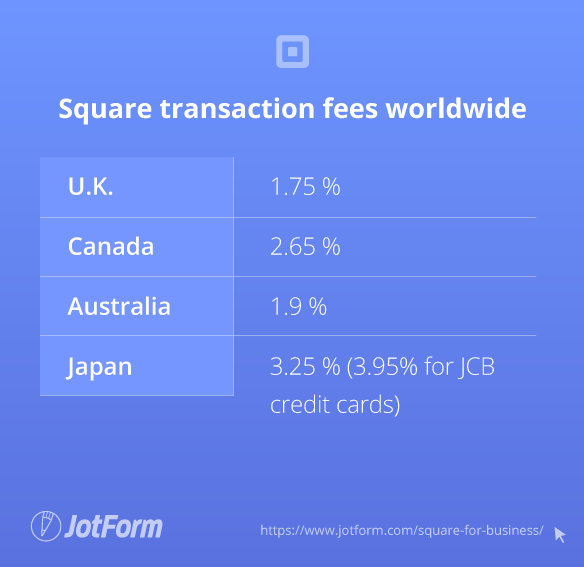

Square transaction fees worldwide

Currently, Square can be used to pay for goods and services in the U.S., U.K., Canada, Japan, and Australia, but not in the U.S. territories of Puerto Rico, Guam, the U.S. Virgin Islands, American Samoa, and Northern Mariana Islands.

Square fees for swipe/chip credit card payments in the U.K., Canada, Japan, and Australia are as follows.

| Country | Fees |

| U.K. | 1.75 percent |

| Canada | 2.65 percent |

| Australia | 1.9 percent |

| Japan | 3.25 percent (3.95 percent for JCB credit cards) |

How Square costs compare to the competition

Trade industry publications and merchant services associations continue to rank Square as a top provider of credit card transaction hardware and software for small businesses.

Part of Square’s appeal is the transparent fee structure. For businesses with sales of less than $250,000 annually, there are no customized fees, and you don’t have to call the Square sales team to see a full listing of all transaction and equipment fee options.

Many transaction-processing providers do not provide a full listing of fees on their websites. Instead, many of Square’s competitors offer customized cost quotes for each new business that signs on. What’s more, there are often hidden costs not reported on their customer-facing materials, like setup fees, application fees, and compliance costs.

Keeping in mind that data on some payment options, such as wireless NFC payment, were not available for all competitors, the chart below focuses on basic swipe and chip transactions.

Here’s how Square stacks up against the competition:

| Payment processing provider | Fees |

| Square | 2.75 percent per swipe/chip transaction 3.5 percent plus 15 cents per keyed transactions |

| Clover | $29 per month plus 2.3 percent plus 10 cents per transaction |

| PayPal | 2.7 percent per swipe transaction in store2.9 percent per transaction plus 30 cents per online transaction3.5 percent plus 15 cents per keyed transaction |

| Stripe | 2.9 percent plus 30 cents per transaction up to $1 million in sales per year |

| Merchant Services | 10–15 cents per transaction, plus $10 per month statement fee |

| First Data | 0.39 to 1.89 percent plus 15 cents per transaction |

| Helcim | 0.25 percent plus 8 cents per transaction |

How Square can kick-start your business

If you’re just starting a new business, you have enough to worry about and plenty to learn without becoming a finance expert. And you likely don’t have loads of ready capital to invest in a POS system. Some small-scale entrepreneurs may not even have a permanent location to house a bulky register capable of processing credit, debit, and gift cards.

Square empowers small business owners by supplying them with an intuitive, affordable, and portable way to accept a wide variety of payment methods, as well as scalable options that are ready to adapt and grow as quickly as their customers’ needs.

Since their launch in 2009, Square has streamlined credit card payment processing for small vendors, allowing artists, artisans, nonprofits, seasonal vendors, and more to accept credit card payments in just minutes without having to invest in expensive or bulky equipment. As of 2019, more than 2 million businesses were using Square to process transactions.

Even as Square has grown and expanded their offerings for small businesses and startups, simplicity — from the clean design of their signature square dongle to the sleek new Square Terminal introduced in October 2018 — has remained a focal point.

Square benefits for small businesses

- Quick startup. Since there are no long-term contracts or lengthy application processes involved with using Square, you can sign up, order your device, download the app, and start accepting payments from your customers as soon as your card reader arrives in the mail.

- No hidden fees. Transaction and equipment fees (on all devices but the swipe dongle) are all you pay. There are no setup, cancellation, or statement fees, and because you only pay transaction fees on a per-sale basis, you don’t have to worry about paying a monthly fee when your seasonal business is on hiatus.

- Money from transactions is available quickly. Square promises their customers that payments from credit card purchases will appear in their accounts within one to two business days. You can even access payments instantly for a 1-percent fee.

- Sales and inventory tracking. Square Analytics automatically breaks down sales trends and inventory on a per-sales basis, so you can access detailed reports via your dashboard throughout the day, allowing you to make better purchasing decisions and grow your business more easily.

- Software solutions that are accessible anywhere. Because you can access inventory and sales data from any device that has the Square POS app, you can view your dashboard from anywhere. You don’t have to spend time away from customers in the “back office” to keep up with inventory and other accounting activities. You can even monitor sales via your smartphone or tablet when you aren’t onsite.

- Square offers scalable solutions. Startups can grow in fits and starts or take off unexpectedly. This means that the needs of owners, workers, and customers are in a constant state of flux. With Square, business owners can start small, with no equipment investment, and then scale up when and if needed.

Square for the mobile entrepreneur

Thanks to Square, artists, consultants, and small-scale entrepreneurs who could previously only accept checks or cash can now accept credit cards easily from anywhere. Since you only pay transaction fees when you have sales, Square is a great option for artists or mobile goods dealers whose businesses are targeted to seasonal festivals or for nonprofits that depend on event-driven fundraising transactions.

DIY crafters, artists and artisans, art and antiques dealers, local farmers, and all manner of small-scale entrepreneurs can begin accepting credit and debit cards without paying any startup costs. All they have to do is attach Square’s swipe dongle to the headphone jack or Lightning jack on their iPhone, Android, or tablet, or connect the chip reader to their device via Bluetooth. The attachment is small enough to fit on the corner of a small table without taking up valuable display space.

Each new account comes with a free magstripe dongle, or you can upgrade to a chip reader for $49. If, in the future, you take on employees or multiple locations, each additional magstripe reader is $10. Square sells a version of the dongle that attaches to your smartphone through a headset jack and another version that attaches to newer Apple products through a Lightning connector.

Square also extends your reach, allowing you to accept credit card payments from customers across the country and around the world. You can instantly sell your services and products without having to wait for payments to arrive by mail, and it spares your customers and clients the hassle of writing a check or obtaining a money order.

As your business expands, you can add or change devices at the point of sale. For example, if you find your festival or flea market-focused business beginning to grow and decide to invest in a storefront, you can upgrade to a Square Reader for $49, and so on.

With incremental levels of investment, you can easily turn a side hustle or passion project into a lucrative business without having to learn a whole new POS system.

Square for the seasonal business

Because the only fees you pay aside from equipment costs are per transaction, Square is a less stressful option for seasonal businesses than merchant services providers with annual or monthly fees.

Christy Houser, co-owner of Wilderness Cove Campground in Saluda, North Carolina, says implementing Square helped grow her business.

“The Square Register was very intriguing to me, and it did not disappoint! We run that as our main station, but we also use tablets with the stands and the app on our phones. It makes taking payments from anywhere on the campground possible,” she says.

“The Register and Stands are so fast, they really sped up our process. I also love the real-time reports. I can be at my home office and know exactly what is happening in our offices. It has really done almost everything I have needed it to do.”

Square for retail

If your business has graduated from the back of your car or truck to a brick-and-mortar location, or if you’re starting out in a storefront, then the higher volume of sales may mean it’s time to graduate to Square’s Register or Terminal.

According to FastCompany, Square’s sleek-looking Terminal, their most recent hardware offering, is a “gateway to an entire ecosystem of small-business solutions.” Integrated add-ons to Square’s POS app include appointment and booking software, payroll, and e-commerce and marketing tools such as loyalty program setup.

Square can help you set up discounts, send digital invoices, use analytics, and generate reports to monitor and guide the growth of your business. The Square Online app can sync online and offline inventory, calculate shipping costs, and manage delivery. It can also synchronize onsite pickup for online orders and track inventory and purchasing.

Kallie Wesley, who co-owns the lifestyle retail space Juxtapose in Hyde Park, Florida, along with her sister Lindsay, says that Square’s inventory and purchasing capabilities help them track profits.

“We use Square to manage the cost of goods and ensure our margins are intact, and understand where our sales are vs historical sales,” she says. “Keeping on top of our inventory is really important, since many of our items are one of a kind. It also helps us break down brands and categories, so we can better track sales trends.”

Square Payroll users have the option of integrating health insurance and retirement benefits for their employees paid for by automated deductions and business contributions.

When Square user Mary started hiring help to run her Kona Ice truck in Sainte Genevieve, Missouri, she began using Square Payroll.

“Getting started was so easy. I figured it out mostly by myself with a little help from Square. I even remember running payroll not knowing if I had done it right because it was so simple,” she says. “Running payroll only takes about five minutes. When it’s time to run it, I get a reminder by phone and email. I log in, look at timecards, import timecards, hit Pay my employees, and I’m done! I’m totally done! It’s that easy.”

Square can help you set up a digital storefront featuring sophisticated, easy-to-implement design options that won’t require you to hire a web designer. They can also help you create customized gift cards.

Square allows service providers that rely on appointments — from nail salons to repair shops — to book clients directly through Google and Instagram. Clients can also book online through your digital storefront.

According to Square’s website, at businesses that have implemented their customer loyalty program, like Asha Tea, patrons who enroll in Square Loyalty are twice as likely to be return customers. “It’s great having a loyalty program integrated with our register,” says Asha Tea’s creative director, Diana Lui. “It’s easy for customers to sign up and understand, and easy for our employees too.”

Because Square allows owners to access so much information — inventory, scheduling, accounting, and more — from their devices, you can spend less time in the back office and more time interacting with customers.

Business owners who use Square card readers can use a debit card custom designed with their business logo to access cash from an aligned account. Because Square debit accounts allow users to easily differentiate business expenses from personal purchases, tallying year-end tax deductions are that much easier. In addition, Square offers accounting software integration.

Square even offers small business loans that can be paid back automatically via future credit card transactions. Their Square Wallet program has distributed more than $1 billion in loans to upwards of 100,000 small businesses.

Square for Restaurants

Square has earned high ratings from restaurateurs and their patrons for ease of use. Their Square for Restaurants system contains many convenient extras, such as automated ways to maintain an open tab or split a bill. It can also prompt customers to pay tips onscreen.

Square for Restaurants can help your wait staff work more efficiently by managing employee schedules, tables, and seating as well as updating menus. Square’s website provides a video and step-by-step instructions for how to implement the many features of Square for Restaurants.

Square for Restaurants users can use the Caviar mobile payment tool integration to accept payment on-delivery services. Transactions automatically integrate with pickup and eat-in orders.

Through their partnership with TouchBistro, Square has been able to integrate food preparation and delivery efficiency with streamlined payment sales assessment tools, expanding their range of services to restaurants, bars, caterers, and food trucks. In fact, a business with multiple locations and food services can be integrated into a single Square account for maximum efficiency.

Square uses their social media presence to solicit requests for new features and feedback from customers. One example of how they revamp their offerings to meet customer needs is the recent implementation of time-based discounts (think happy hour) in the Square for Restaurants system.

Michael Solomonov and Steve Cook, cofounders of CookNSolo Restaurant Partners, in Philadelphia, were early adopters of Square for Restaurants, which launched in 2018.

“There’s always going to be curveballs that the restaurant life throws at you — Square for Restaurants is not one of them. It’s robust while retaining that trademark Square elegance and hassle-free service,” they said.

Square for Nonprofits

With Square you only pay fees on the transactions that you make, and there are no annual or monthly fees. As a result, Square may be a good option for nonprofits with seasonal fundraising POS needs. At the same time, Square’s ability to compile donor information quickly at the point of transaction can be extremely helpful for future fundraising.

Because Square customers who shop with one another enjoy a 2.75-percent discount anyway, it makes sense to partner with fellow local users for nonprofit activities and outreach.

If your total sales (or donations from sales) exceed $250,000 annually, Square offers customized solutions for your business or organization.

Square’s Business Resource Center

Square’s online blog, the Business Resource Center, offers a range of articles to help customers leverage Square’s many services to grow their businesses. In addition to management and marketing tips and overviews of new features, the center spotlights Square customers who offer advice and insights on how they use Square in their own small businesses.

Recent topics include how to take over the family business, steps to consider before opening a new location, and how to leverage Instagram to grow your business.

How to use JotForm with Square

Once you’re all set up with Square, you may think you’re ready to rock ’n roll and watch the money multiply in your bank balance. Truth be told, that may very well be the case if you’re a brick-and-mortar storefront, a bustling restaurant, or even a market monger selling your wares at fairs and festivals.

In these cases, Square’s selection of terminals, stands, and on-the-go readers paired with their POS software, app, and dashboard may be the all-in-one payment processing solution you need to quickly and seamlessly capture your customers’ card and contact information.

On the other hand, if you’re a do-it-your-selfer, a professional services provider, a nonprofit accepting donations, an event organizer, or even an order-based business, you may find that using Square — and only Square — still comes with quite a few time-consuming, tedious processes that compromise the time you need for more business-critical activities.

For example, if someone wants to attend your big fundraising gala, which requires a ticket, you need to find a way for them to sign up, and you need to collect their contact information, manually input it into Square, and manually create an invoice to send them. Now, imagine the gala is for 1,000 people. Ugh!

The time wasted on these kinds of administrative tasks adds up, and what business owners in these kinds of situations really need is an all-in-one solution that both captures customer information and seamlessly integrates with Square as a payment processor.

Enter JotForm, the world’s easiest online form builder! With JotForm, small businesses across the spectrum can quickly and easily create online forms, like registration forms, subscription forms, order forms, signup forms, and more, to collect key details.

They can then share these forms on their website or social media, where they’re easily accessible to clients, customers, and registrants. This passes on the burden of filling in relevant contact information to the participant, saving you — the business owner — critical time and energy.

And best of all, JotForm is one of the only free form builders on the web that also integrates with a huge host of payment processors, such as Square.

That means your customers can place their order, complete their signup, or select their services, and make a payment. More important, it means you can spend more time on the tasks that really matter.

Why JotForm?

- It won’t break the bank. JotForm has four different pricing tiers depending on your needs. Their starter offering is completely free. That means you get 100 monthly form submissions, the opportunity to process 10 payments, the use of five different forms, and an unlimited number of form fields per month. If you need a more robust solution, you can choose from one of the three other product offerings.

- It only takes 10 seconds. With JotForm, you can create an online form faster than you can brush your teeth. That’s how simple it is to use the software.

- No tech knowledge required. JotForm doesn’t expect dentists to also be developers. So no matter what your line of business is, you’ll be able to quickly and easily use the intuitive drag-and-drop Form Builder to create an online form and integrate with a payment processor. You don’t have to know a stitch of code.

- Over 10,000 form templates. JotForm has more free online form templates than any other online resource, including templates made particularly for Square.

- Total customization. Make every form look exactly the way you want it to thanks to JotForm’s Form Designer. You can make simple changes, like tweaking a background color and uploading your logo and branding, or injecting your own CSS for more technical customization.

- Maximum data security. JotForm is serious about protecting users’ privacy, especially when it comes to payments. That’s why JotForm is the only form builder that’s PCI DSS Service Provider Level I certified, the highest security attainment you can have as a business that collects payments from, and integrates with, credit cards.

- No additional transaction fees. You don’t have to pay any fees apart from Square’s standard processing fees. JotForm comes with no hidden charges.

Want to know how you can embed Square on your website with JotForm in a matter of minutes? Read more about how to set up both applications quickly and easily.

Helpful blog thanks for share your experience such great information for online payment how its work thanks