Paymill and Your Online Shop: Safe Payment Made Easy

Online shopping has gone mainstream. The local retail business fights for survival. Unsurprisingly, the number of online shops is increasing day by day. But beware, not all online shops are created equal. It’s not enough just taking a ready-made e-commerce software and waiting for some customers to come. You need to think about some success metrics first. Sure enough, you need to neatly arrange your products and to create a meaningful user experience and navigation. But most of all, you need to get the trust of your customers. It begins with offering safe payment methods to make the visitors feel comfortable. Considering that online shopping has increasingly turned into mobile shopping via smartphone or tablet, you need additional in-app payment tools. And some software providers need to handle subscription-based recurring payments. There are solutions from various regions in the world. Nevertheless, we decided to have a closer look at a tool made in Germany. This makes sense for everyone, not only for Germans operating German online shops. As is well known, the German e-commerce jurisdiction comes with a lot of duties and pitfalls. Thus, it is the safest way to go with a provider that is bullet-proof under these conditions also. Paymill takes on many of these worries and tackles them progressively. This should be enough reason to check them out...

SDK Download: SDK for iOS | SDK for Android

SDK Download: SDK for iOS | SDK for Android

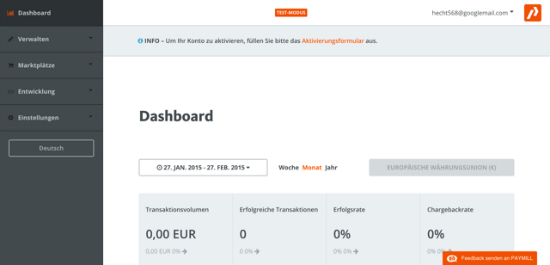

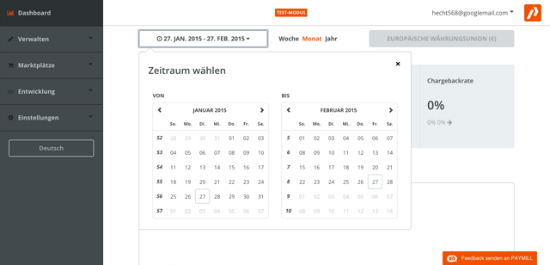

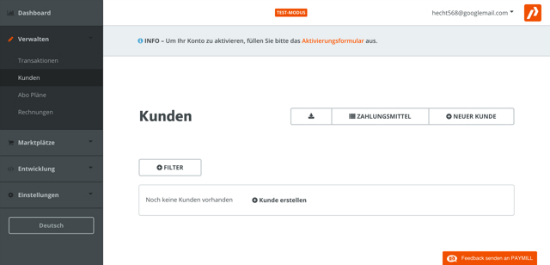

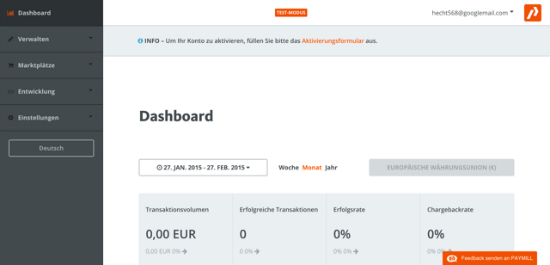

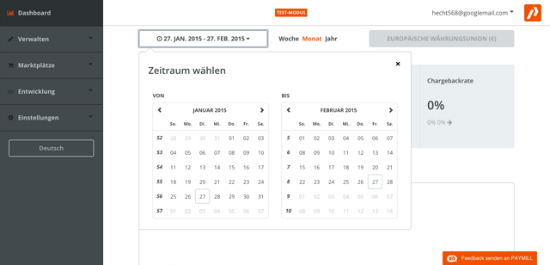

The Paymill Dashboard looks clear and uncluttered, providing a user-friendly, appealing design. After logging in you can grasp all occurring transactions at a glance. They can be displayed per week, month or year. Using its calendar feature, it’s easy to choose a specific time span. See screenshot:

The Paymill Dashboard looks clear and uncluttered, providing a user-friendly, appealing design. After logging in you can grasp all occurring transactions at a glance. They can be displayed per week, month or year. Using its calendar feature, it’s easy to choose a specific time span. See screenshot:

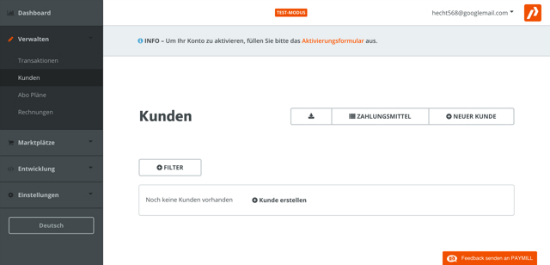

Tools on the right-hand side of the navigation enable you to manage customers, transactions, and invoices. Furthermore, you can create new customers and subscription plans.

Tools on the right-hand side of the navigation enable you to manage customers, transactions, and invoices. Furthermore, you can create new customers and subscription plans.

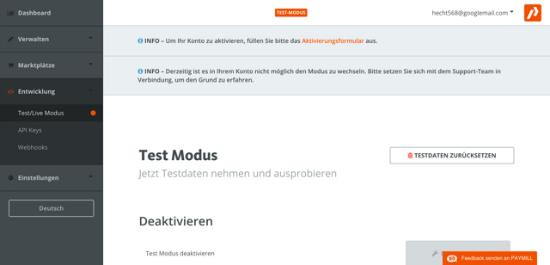

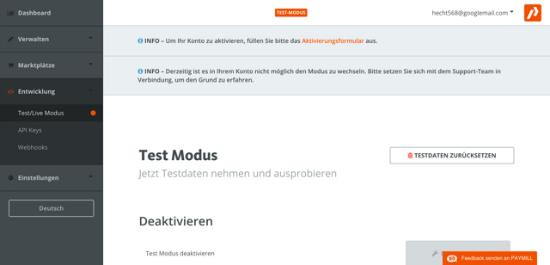

Using the menu item „Development“ you can change from the default „testing mode“ to the live mode. You will not want do this until you have run all tests within Paymill successfully, and everything works without any problems, however. From here you are also able to retrieve the API keys needed for the test and live modes, respectively.

Using the menu item „Development“ you can change from the default „testing mode“ to the live mode. You will not want do this until you have run all tests within Paymill successfully, and everything works without any problems, however. From here you are also able to retrieve the API keys needed for the test and live modes, respectively.

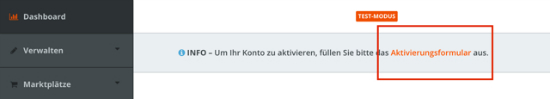

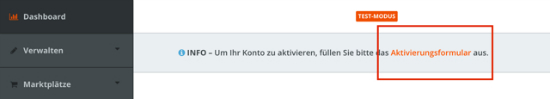

The link to the activation form sits at the top of the dashboard, and it’s clearly marked. It will only disappear after you complete and save the form.

The link to the activation form sits at the top of the dashboard, and it’s clearly marked. It will only disappear after you complete and save the form.

After having finished the activation form you can start with integrating Paymill into your website and thoroughly testing it.

After having finished the activation form you can start with integrating Paymill into your website and thoroughly testing it.

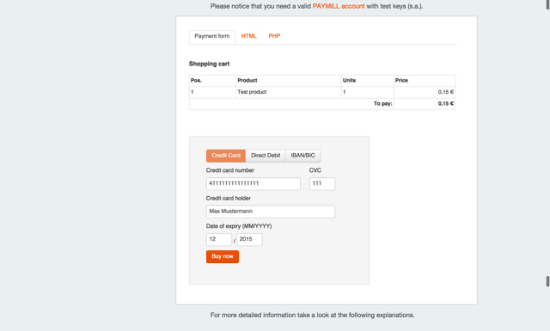

[caption id="attachment_56945" align="alignnone" width="400"]

[caption id="attachment_56945" align="alignnone" width="400"] Shopping cart with payment data[/caption]

Shopping cart with payment data[/caption]

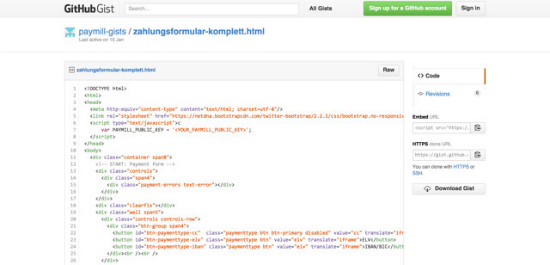

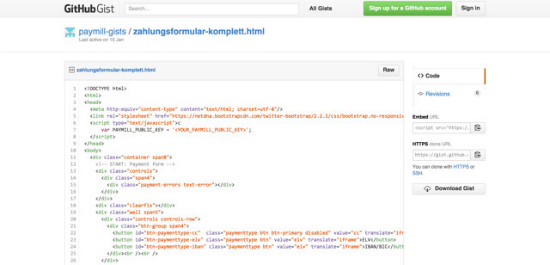

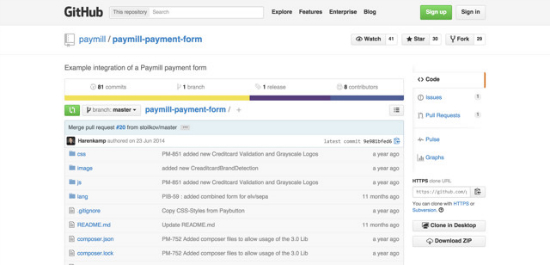

Over at Github Gists, you will find a complete sample form to download and play around with. Github itself provides a somewhat more complex form including all necessary files.

Payment form to download as gist

Over at Github Gists, you will find a complete sample form to download and play around with. Github itself provides a somewhat more complex form including all necessary files.

Payment form to download as gist

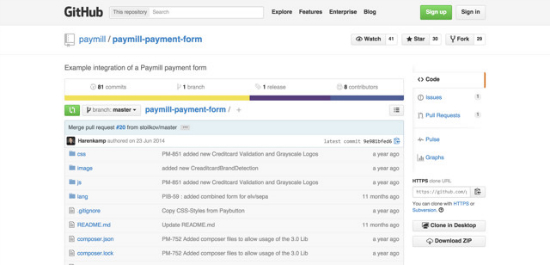

Example for a complete Paymill integration

Example for a complete Paymill integration

Paymill documentation (including developer API)

Paymill documentation (including developer API)

PAYMILL Alerting is an add-on that sends you and your customer a notification email for every transaction and any change in its status.

It will send notifications for the following transactions and status changes (successful/failed):

PAYMILL Alerting is an add-on that sends you and your customer a notification email for every transaction and any change in its status.

It will send notifications for the following transactions and status changes (successful/failed):

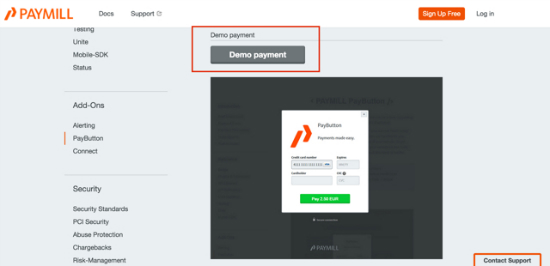

Documentation PayButton with clickable demos

Documentation PayButton with clickable demos

A short and simple HTML code is sufficient to integrate the add-on into your shop.

A short and simple HTML code is sufficient to integrate the add-on into your shop.

What Paymill Can Do For You

1. Handling of Online Payment Transactions

Online payments made easy – that’s the claim of the online shop payment solution and software-as-a-service provider. Paymill can handle your complete payment transactions globally, enabling you to accept online payments from around the world without your customers having to leave your website. Additional to handling the payments itself, Paymill provides the complete payment and subscription parts via web forms. Furthermore, there are plugins for easily embedding and managing the solution inside the most popular online shop software tools.2. In-App Payments for iOS and Android

Paymill’s API offers all benefits of an online payment solution and comes optimized for mobile apps. Paymill provides SDKs for Android and iOS. These tools enable you to build and design a responsive and personal checkout process. One click payment is another option, whereby customer payment data will be stored on Paymill’s servers. SDK Download: SDK for iOS | SDK for Android

SDK Download: SDK for iOS | SDK for Android

3. Subscription Payments

For business models like SaaS or Cloud, Paymill offers a subscription-based option with the goal of easy handling of recurring payments. Ideally, such a tool can also help you increase customer retention and revenues by automating processes. Subscription models can be modified in accordance with different customer segments, boosting your conversion rates. With Paymill, you are also able to offer trial periods to your clients. Payments can be processed automatically on a daily, weekly, bi-weekly or monthly basis.

Accepted Payment Methods

In essence, Paymill offers accepting the globally most popular credit cards – since credit cards are the preferred payment tool internationally, anyway. Paymill takes and processes payments all over the world, which makes for a whole lot of accepted credit cards. Especially for European retailers, Paymill also offers SEPA direct debiting. The following credit cards are supported:- Visa/Visa Electron/Visa Debit

- MasterCard/Maestro/MasterCard Debit

- Diners Club

- Discover

- China Union Pay (except in Croatia)

- American Express (AMEX) (only in Germany, France, the UK, Spain, Finland, Sweden, Itay, the Netherlands, and Austria)

- JCB (except in Croatia)

- Card Bleue in France

- CartaSi and Postepay in Italy

- Dankort Debit Card in Danmark

- 4B Visa Debit and MasterCard in Spain

PayPal: Important Payment Method Missing Here

Sure enough, it’s great to have all these credit cards supported. Nevertheless, it limits your opportunities to grow your customer base beyond those clients owning credit cards. Which not everybody does. PayPal, on the other hand, is a widely used and internationally accepted payment method. An ever-growing number of online shoppers own a PayPal account. Because it’s missing here, it would be nice if Paymill did add this option.Supported Currencies

During initial creation and activation of your Paymill account, you set the currency of your company’s location. In all, more than 100 currencies are supported. During the activation, you can add more currencies by choosing the menu item „Payment methods“ and clicking „Yes“. As shown in the video below.

The Costs of Using Paymill

Unlike some contestants, Paymill doesn’t charge any monthly or even setup fees. The pricing is rather simple and transparent; you pay per transaction.Debit Cards

VISA, MasterCard, China Union Pay, Diners Club, Discover, JCB*, CartaSi, Carte Bleue, Dankort, Postepay, V PAY, VISA Electron and Maestro Cost per transaction: 2,95% + 0,28€ | JCB in select (but unspecified) countries 3,25%American Express

Cost per transaction: 3,95% + 0,28€SEPA Direct Debit

Cost per transaction: 0,19€Safeguarding the Payment Transactions

When doing business online, a growing number of people put emphasis on secure payment transactions and not having their payment data compromised. As an entrepreneur, you should, too. Paymill is fully compliant here and meets all relevant industry standards. Security requirements according to PCI (Level-1 PCI compliance), 3-D Secure, HTTPS, SSL, and 256-bit-encryption are applied, safeguarding processes and customers. Paymill’s data security and data privacy measures get reviewed and examined by TÜV Saarland, a big German certification authority. The company is also a recognized partner of Trusted Shops.

- PCI - Payment Card Industry Data Security Standard

- 3-D Security Standard

- Trusted Shops Seal of Approval

The Paymill Dashboard

The Paymill Dashboard looks clear and uncluttered, providing a user-friendly, appealing design. After logging in you can grasp all occurring transactions at a glance. They can be displayed per week, month or year. Using its calendar feature, it’s easy to choose a specific time span. See screenshot:

The Paymill Dashboard looks clear and uncluttered, providing a user-friendly, appealing design. After logging in you can grasp all occurring transactions at a glance. They can be displayed per week, month or year. Using its calendar feature, it’s easy to choose a specific time span. See screenshot:

Tools on the right-hand side of the navigation enable you to manage customers, transactions, and invoices. Furthermore, you can create new customers and subscription plans.

Tools on the right-hand side of the navigation enable you to manage customers, transactions, and invoices. Furthermore, you can create new customers and subscription plans.

Using the menu item „Development“ you can change from the default „testing mode“ to the live mode. You will not want do this until you have run all tests within Paymill successfully, and everything works without any problems, however. From here you are also able to retrieve the API keys needed for the test and live modes, respectively.

Using the menu item „Development“ you can change from the default „testing mode“ to the live mode. You will not want do this until you have run all tests within Paymill successfully, and everything works without any problems, however. From here you are also able to retrieve the API keys needed for the test and live modes, respectively.

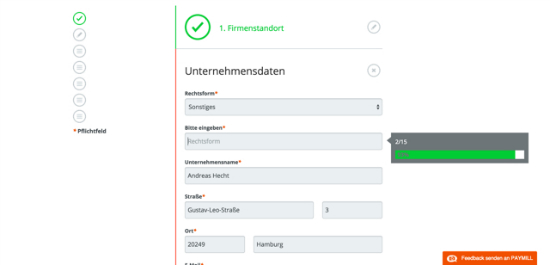

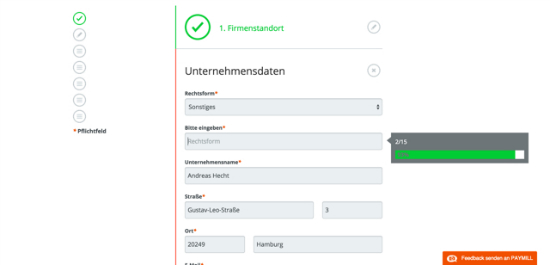

Activation: Important First Step

After registering, you should complete the activation form first. This will take a few minutes, and you should have all relevant company data at hand, like your VAT identification number. The link to the activation form sits at the top of the dashboard, and it’s clearly marked. It will only disappear after you complete and save the form.

The link to the activation form sits at the top of the dashboard, and it’s clearly marked. It will only disappear after you complete and save the form.

After having finished the activation form you can start with integrating Paymill into your website and thoroughly testing it.

After having finished the activation form you can start with integrating Paymill into your website and thoroughly testing it.

Integrating Paymill into the Online Shop

Basically, there are two ways to integrate Paymill into a website or an online shopping environment. First, by doing it manually as described above and second, by using a plugin, available for many of the most popular e-commerce software packages.1. Integration Using a Plugin

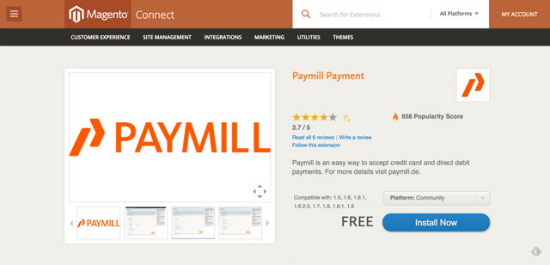

The following e-commerce plugins are available: Magento

- Developer: Paymill

- Regular updates: Yes

- Latest version: Oct 29, 2014

- Compatible with release: 1.5, 1.6, 1.6.1, 1.6.2.0, 1.7, 1.8, 1.8.1, 1.9

- Download link

- Developer: Paymill

- Regular updates: Yes

- Latest version: not known

- Compatible with release: 4.7.x - 4.8.x

- Download link

- Developer: Paymill

- Regular updates: Yes

- Latest version: 2015, January 20

- Compatible with release: v1.4.0.1 - v1.6.0.13

- Download link

- Developer: Paymill

- Regular updates: Yes

- Latest version: 2014, November 14

- Compatible with release: 4.0.0 – 4.3.2

- Download link

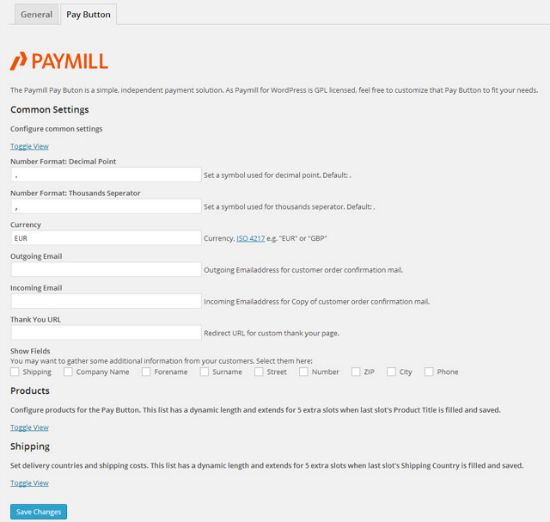

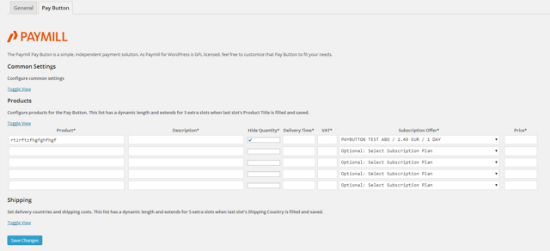

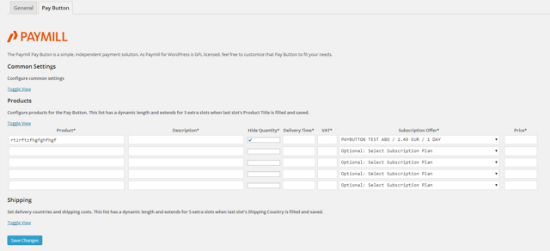

- Developer: Matthias Reuter

- Regular updates: Yes

- Latest version: 2015, February 26

- Price: free on WordPress.org

- License: GNU GENERAL PUBLIC LICENSE

- Interactions with other plugins: not known

- Download link

- WooCommerce (2.2.x) + WooCommerce Subscriptions (1.5.x)

- Magic Members (1.8.x)

- ShopPlugin (1.3.5)

- MarketPress (2.9.x)

- Cart66 Lite (1.5.1.17)

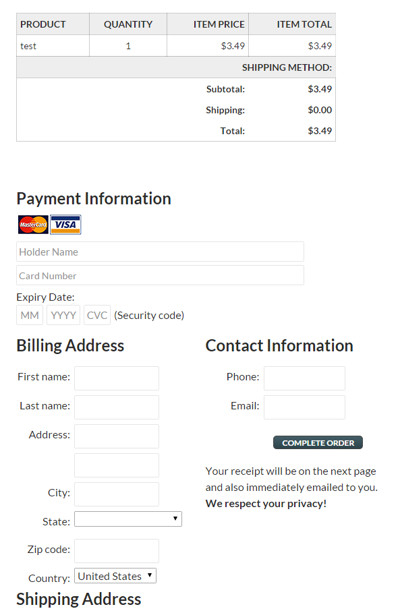

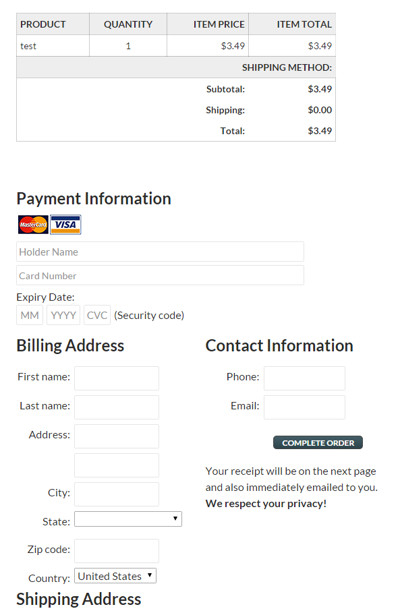

[caption id="attachment_56945" align="alignnone" width="400"]

[caption id="attachment_56945" align="alignnone" width="400"] Shopping cart with payment data[/caption]

Shopping cart with payment data[/caption]

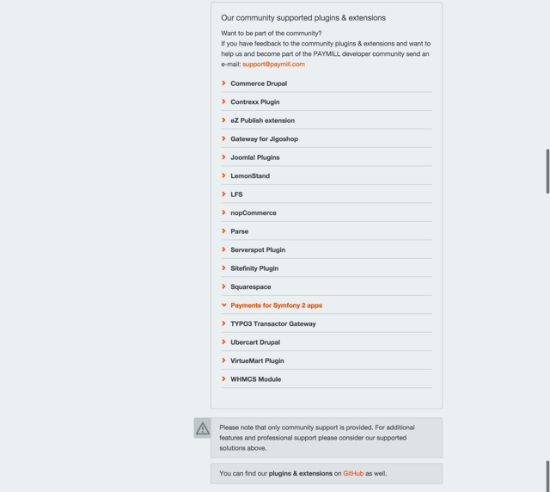

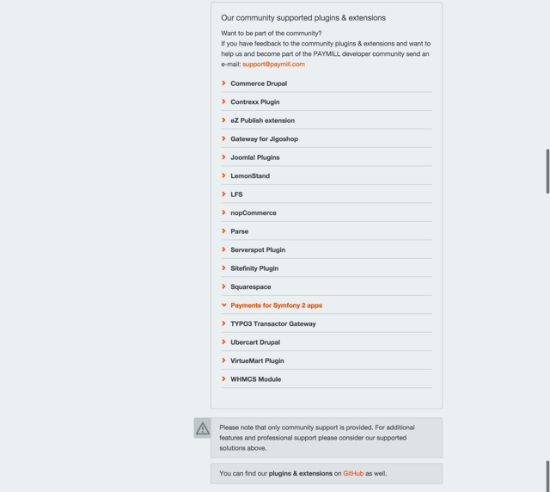

Inofficial: Plugins Made by the Community

In addition to the officially supported shop integration plugins there a several more options, compatible with the most popular content management systems, like Drupal, Typo3, and Joomla!. These plugins don’t receive official support, rather counting on the support of their respective community. This works pretty well since they are always very helpful with advice and assistance.

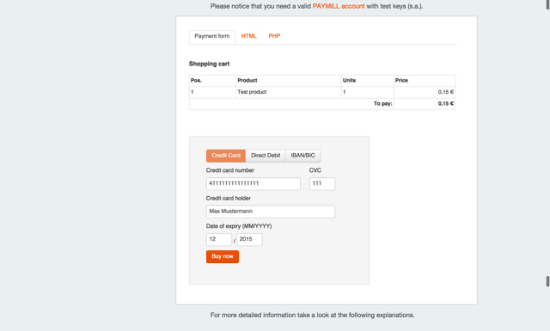

2. Manual Integration

There’s an excellent elaborate and comprehensive documentation explaining how to integrate Paymill manually into the shop. Additionally, there is an example of a shopping cart complete with HTML and PHP code to copy and integrate into your website. Over at Github Gists, you will find a complete sample form to download and play around with. Github itself provides a somewhat more complex form including all necessary files.

Payment form to download as gist

Over at Github Gists, you will find a complete sample form to download and play around with. Github itself provides a somewhat more complex form including all necessary files.

Payment form to download as gist

Example for a complete Paymill integration

Example for a complete Paymill integration

Paymill documentation (including developer API)

Paymill documentation (including developer API)

Payment and Accounting Processes for Retailers

For anyone using Paymill, the payments and accounting processes are without any doubt utterly important. At this point, we'll let Paymill itself have their say.Payment Process Regarding the Retailer According to Paymill:

- "All transactions processed using PAYMILL are settled on a weekly basis by one of our acquiring banks. The first settlement may be delayed depending on your go-live day."

- "In order to avoid small bank transfers a minimum threshold of 100€ is setup for your weekly settlements."

- "A negative balance invoice is generated if during one settlement cycle the volume of your credited (refunds/chargebacks) transactions exceeds the debited ones. Your merchant account will hopefully be rebalanced for the next payout cycle through your future transactions. If you have a negative balance over several settlement cycles, our acquiring bank will ask you to wire the funds in order to rebalance your merchant account."

- "If a rolling reserve is applied to your transactions, your funds will automatically be settled with one of your weekly settlements after the given period in your contract."

- "The percentage transaction fee will automatically be deducted from the transaction volume processed during your settlement cycle, and you will be invoiced for the fixed fee separately."

Two Types of Billings Are Provided:

- A monthly invoice containing a total of all the fixed fee transactions

- A weekly settlement file containing the cumulated transaction volume (transaction fees deducted)

Little Helpers: Paymill Add-Ons

1. Paymill Alerting

PAYMILL Alerting is an add-on that sends you and your customer a notification email for every transaction and any change in its status.

It will send notifications for the following transactions and status changes (successful/failed):

PAYMILL Alerting is an add-on that sends you and your customer a notification email for every transaction and any change in its status.

It will send notifications for the following transactions and status changes (successful/failed):

- Transactions

- Subscriptions

- Refunds

- Chargebacks

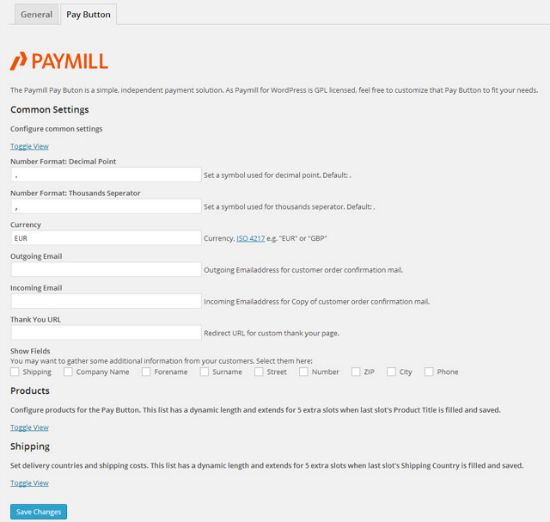

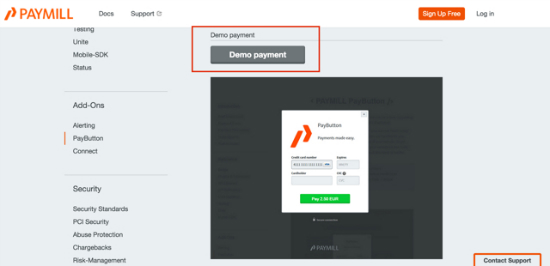

2. PayButton

Paymill’s PayButton is a fast way to integrate a payment form into your website, sparing you the need to design a complete shopping cart and registering form. It’s especially well-suited for online shops with only a limited number of products (e.g., if you sell just one e-book). Integrating the button is easy. Ass soon as you click it a so-called modal window opens (like a pop-up). See the marked button in the following screenshot. Below, there’s a window with the open form. Documentation PayButton with clickable demos

Documentation PayButton with clickable demos

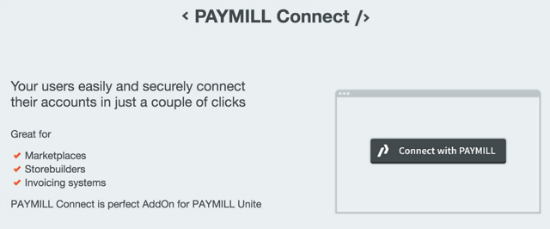

3. Paymill Connect

With Paymill Connect, you enable prospective customers to register with just some clicks using OAuth2. Some people prefer to register with their Facebook or Twitter accounts, instead of putting in all relevant data manually. A short and simple HTML code is sufficient to integrate the add-on into your shop.

A short and simple HTML code is sufficient to integrate the add-on into your shop.

Paymill Support

Sometimes you get stuck and need help. That’s why a reliable support is so important in order to keep your online business rolling. Retailers can reach the Paymill support either via the contact form or by phone Monday to Friday during business hours (9 am-6 pm).

Paymill Partner Portal: 3rd Party Support for Integration and Operation

The Paymill Partner Portal is a virtual meeting point for online retailers and Paymill professionals. It providest help in finding the best partner for integrating the solution. Paymill Partner Portal

Conclusion

Paymill is a well-conceived and sophisticated solution for online payments which is also kind of easy to install at the same time. The option of using a „light version“ by just installing the PayButton is a great idea – providing a secure and professional payment process even for websites with only a handful of products. It’s a pity, though, that PayPal is not one of the payment methods. This should be added since not everybody owns a credit card or wants to use it when shopping online. Other than that, it's great...Related Links

- Paymill Homepage

- SDK Download for Mobile Apps: SDK for iOS | SDK for Android

- PCI - Payment Card Industry Data Security Standard

- 3-D Security Standard

- Trusted Shops Seal of Approval

- OAuth2 - Open standard for authorization

- How to manually integrate a payment form into your website

- Paymill API library for developers

- Paymill documentation

- Paymill FAQ

- Paymill Partner Portal

- Payment form to download as gist

- Example for a complete Paymill integration

- Plugin for Magento

- Plugin for OXID

- Plugin for PrestaShop

- Plugin for Shopware

- Plugin for WordPress